At first look, the “new business strategy” invokes military-type HQ, futuristic glass windows, and plasma screens loaded with real-time data analysis. However, at PortaOne, we humbly follow the customer’s needs. So, our journey into the brave new world of billing software for EV charging started one day when a good old email arrived in the sales@portaone.com inbox. A prospect wanted to know if we were interested in stepping out of our industry box (that is, telecom) and trying something new.

Electric vehicles are estimated to grow from 8,151K units in 2022 to 39,208K in 2030, with a CAGR of 21.7%. That’s one of the best growth indicators globally (after VR gaming, predictive health care, and cannabis edibles)! And someone has to write and maintain the billing software for all the charging stations that will support those EVs. It’s no wonder we gladly replied “yes” to that customer request after some quick business case research.

This Is Not a Drill!

PortaOne has long been looking at neighboring industries to scale up PortaBilling. However, our new “EV billing venture” is an addition to our existing telecom business, not a substitute. In today’s story, we explain our view on the status quo in billing software for EV charging (and on its elder sibling: billing software for utilities) and our plans for market entry.

This story is a prelude to a series of posts we plan to publish over the course of this year. In it, we’ll cover PortaOne’s overall vision for PortaBilling and the growth of our business outside of telecom. (Which will continue to be our primary focus and No. 1 priority.)

What Can PortaOne Bring to the Field of Billing Software for EV Charging?

“Everything new is a well-forgotten old. Google Docs and Sheets were like Microsoft Office back in 1997,” jokes Andriy Zhylenko, CEO of PortaOne CEO. “The new features resemble the evolution of Office 1995 to Office XP. Soon we might see Google’s take on Clippy, the LLM-powered virtual office assistant.”

Likewise, billing software for EV charging is following a similar path to telecom billing. EV entrepreneurs are trying to invent what telecom folks have already invented.

Back in the 1990s and 2000s, the telecom crowd was already exploring most of the business ideas we are now hearing from companies working in EV charging and utilities:

- Subscriptions

- Corporate EV charging accounts

- Prepaid PAYG vouchers (virtual now, compared to telecom’s printed ones)

- Convergent billing: home utilities + e-mobility (a fancy term for an ecosystem consisting of EVs, charging stations, and various charging and maintenance apps), etc.

Still, adopting a telecom business model to EVs, e-mobility, and the smart grid is far more nuanced than merely “reinventing Clippy.”

How Is Telecom Billing Similar to (and Different from) Billing Software for EV Charging and Utilities?

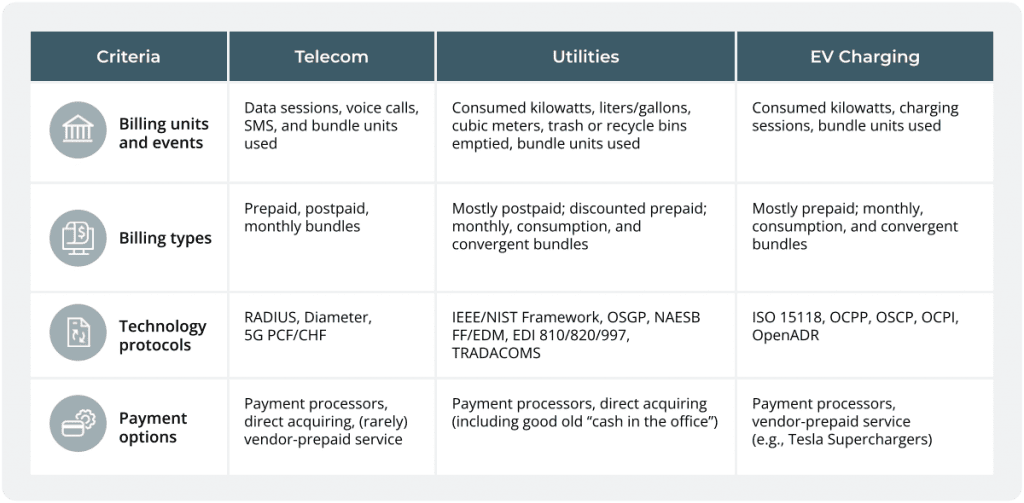

Here’s a table we brainstormed to compare the telecom, utilities, and EV charging industries. After this, we’ll dive into a deeper explanation for each column.

Charging Money v. Charging an EV

One linguistics issue is crucial here. When our team discussed our early notes on this story, we got stuck on the phrase “charging for charging.” It makes little sense in plain English. However, this concept is correct when it comes to explaining how you charge money (see Ericsson, for example) for energy (kilowatts) provided to an EV to recharge its batteries. Some pretty strange terminology arises when telecom and e-mobility converge!

Monthly bundles

The rationales behind monthly bundles are similar within the billing models for all three industries. First, stimulate adequate service consumption (data, voice, messages, kilowatts, liters, or gallons) by pre-selling discounted bundled consumables. That pre-arranged consumption gives providers guaranteed income for a healthy amount of services — the optimal amount for their infrastructure to accommodate.

Consumption Bundles

Consumption bundles in telecom stimulate more service consumption by providing discounts for a prepaid volume of services. Likewise, electricity, utilities, and e-mobility consumption bundles boost service consumption: kilowatts, liters, or charging minutes. Here’s an analysis of some existing consumption bundles. PortaBilling can enable each billing software scenario for EV charging or utilities.

Off Peak-Hours Consumption

This consumption bundle stimulates consumption within a specific time of the day (or week). The rationale is to promote the consumption of electricity during off-peak hours (a.k.a. “night rates,” although off-peak hours aren’t necessarily “at night”).

EVs have one of the most substantial electricity consumption levels among existing devices. Most come equipped with charging timers that allow scheduled charging. This type of charging does not require any real-time supervision from the driver. That’s why EV charging became one of the most significant usage types for “night rates.” A great example is Synergy EV Add-On, created by Western Australia’s largest electricity generator and retailer.

“Green” (Renewable) Energy Consumption Bundles — and What Is (Sometimes) Wrong with Them

Technically a subtype of consumption bundles (based on the origin of the electricity consumed), renewable energy bundles deserve a separate section. The “green tariff” is one of the most controversial subjects in the utilities and renewable energy ecosystem. Speaking bluntly, in most cases, it’s neither “green” nor a “tariff”:

- Energy grids in most countries transport bulk electricity and need help distinguishing between sources of this energy. (Hello, nuclear and thermoelectric power plants.)

- The structure of this “tariff” is usually a subsidy:

- A government can provide subsidies to a consumer for installing private renewable energy power sources such as solar (photovoltaic) panels or wind turbines. In some developing countries (hello, Ukraine), this subsidy became a source of a corruption scheme nicknamed the “green oligarchy” by Politico.

- Socially responsible and environmentally sensitive consumers provide it in a developed country to the electricity supplier. The supplier then claims (sometimes truthfully) to reinvest some of its profits into a renewable energy ecosystem.

Here’s what we are trying to explain to any prospective energy distribution entrepreneur reading this: beware of the various reputational and economic risks embedded with the “green tariff.” It may be better to start with more straightforward consumption bundles, moving to renewables after you gather enough market expertise. Adding EVs, fast EV chargers (including Tesla superchargers), and EV charging networks owned by international oil distribution conglomerates to the picture adds another level of ethical complexity.

The Uneven Geography of EV Charging

EV customers travel frequently, and the cost of charging will vary depending on several factors. These include:

- The cost of commercial electricity at the location.

- The cost of ownership of the charging station. (Has this station already recouped the initial equipment and installation costs?)

- The speed of charging. (In other words, this is the charger’s capacity in kilowatts per hour.)

- The competition: What other charging sources are available? If all the above factors are the same, the cost of charging in rural Nevada (or France or Ukraine) and the industrial suburbs of Los Angeles (or Marseille or Lviv) will still differ.

You can find a dozen Tesla superchargers in LA and only three decent ChaDeMo chargers (a slower but relatively fast charging option requiring 1 hour to fully charge a 100-kilowatt Tesla) in the Chernihiv oblast of Ukraine. So, naturally, charging in Chernihiv will cost you more relative to the cost of commercial electricity. However, in actual money, Chernihiv’s charging is still several times cheaper than LA’s. Why? Because Ukraine currently subsidizes its electricity market due to the war. Nevertheless, the Chernihiv charger still gives its owner more margin than a charger in LA. However, the actual net profit of a company running a single charger on the E95 Kyiv — Chernihiv highway and Los-Angeles charging network operator running hundreds of chargers in a single city compares to a cherry berry v. the Sun (hello, the economy of scale.)

Geo-based Consumption Bundles for EV Charging

In some regions, EV charging entrepreneurs can use geo-based bundles to stimulate consumption. Geo-bundles are something akin to the direction of country bundles in VoIP telephony. (Skype and Viber call these “cheap international calls,” with “cheap” here standing for the call quality.)

Convergent bundles

In telecom, “convergent tariffs” are solutions like the ones that happen when a broadband or TV/VoD telco partners with a mobile carrier (or its mobile division) or a smart TV app OTT. (Hello, Netflix, Hulu, or Disney.) The outcome is usually a single account for broadband, digital TV, VoD, OTT, and mobile. But, of course, the top hit (for telecom marketers) is when you get an entire household to join a convergent family plan.

The obvious solution in e-mobility is a convergence between home utilities and charging providers. That’s when billing software for EV charging and the parallel inspiration from telecom shine.

Ways to Pay

Unlike the first GSM calls, which were insanely expensive, Tesla superchargers and other Tesla-branded charging stations were initially free. But, of course, that is “free” to people who have paid over $100K for their Tesla car. 😂 Mobile carriers arrived before debit-card based online payments became mainstream. That’s why the first telcos had postpaid bills or prepaid scratch cards.

Time passed fast; scratch cards are now mostly a collector’s artifact. Most of the global online retail (including telecom, utilities, and EV charging) works via payment processors that accept debit, credit cards, and other regionally preferred payment methods. However, there’s also vendor-prepaid service, made particularly popular by those “free” Tesla superchargers. It’s not new to telecom, either. For example, since the early 2010s, Samsung negotiates from several months up to one year of free mobile data when you buy their devices (especially tablets). You can set up a vendor-prepaid service using PortaBilling.

Billing Software for EV Charging Is the Trailblazer

EV charging is currently the most agile area in which operators (of EV charging stations) are ready to experiment with new technologies. The real profits and untapped potential are still in utilities, though. You might not drive a Tesla or ride on a public electric trolley (temporarily occupied) or EV bus. But you still need light, running water, and electricity to charge your devices.

EV Charging Application Protocols

Currently, at least five protocols regulate communication between vehicles, charging stations, charging infrastructure providers, and (in some cases) the grid. All of them are open, meaning any willing entrepreneur can join and start building new apps and digital infrastructure.

ISO 15118

The International Organization for Standardization published a document in April 2022 under the full name “Road vehicles — Vehicle to grid communication interface — Part 20: 2nd generation network layer and application layer requirements.” (Hence, the complete numeric reference to this standard is ISO 15118-20:2022.)

Among many innovations, ISO 15118 specifies plug-and-charge (PnC) features and bidirectional charging: Vehicle-to-Home (V2H), Vehicle-to-Grid (V2G), and Vehicle-to-Vehicle (V2V). Therefore, plug-and-charge is essential when discussing billing software for EV charging.

OCPP, OSCP, and OCPI

Open Charge Point Protocol (OCPP) specifies the communication between the EV, the charging station, the Charge Point Operator (CPO) back-end systems, and the grid. As a useful addition, the Open Smart Charging Protocol (OSCP) enables CPOs to forecast the available charging capacity on a 24-hour basis. Open Charge Alliance (OCA) maintains both OCPP and OSCP.

Maintained by the EVRoaming Foundation, Open Charge Point Interface (OCPI) allows for roaming setup between various CPOs and e-mobility service providers (EMSPs). In telecom terms, OCPI is the “interconnect for CPOs and EMSPs.”

OpenADR

Maintained by the OpenADR Alliance, OpenADR is a two-way information exchange model for automated demand response (hence, ADR) procedures to balance electricity grid supply/demand and mitigate electricity costs. To a certain extent, OpenADR is the North American counterpart to European OSCP. We will see more “standards rivalry” in the next section, which is dedicated to open smart grid protocols.

Smart Grid v. “Dumb Pipe”: What Do Billing Software for EV Charging and Billing Solutions for V2G Have to Offer?

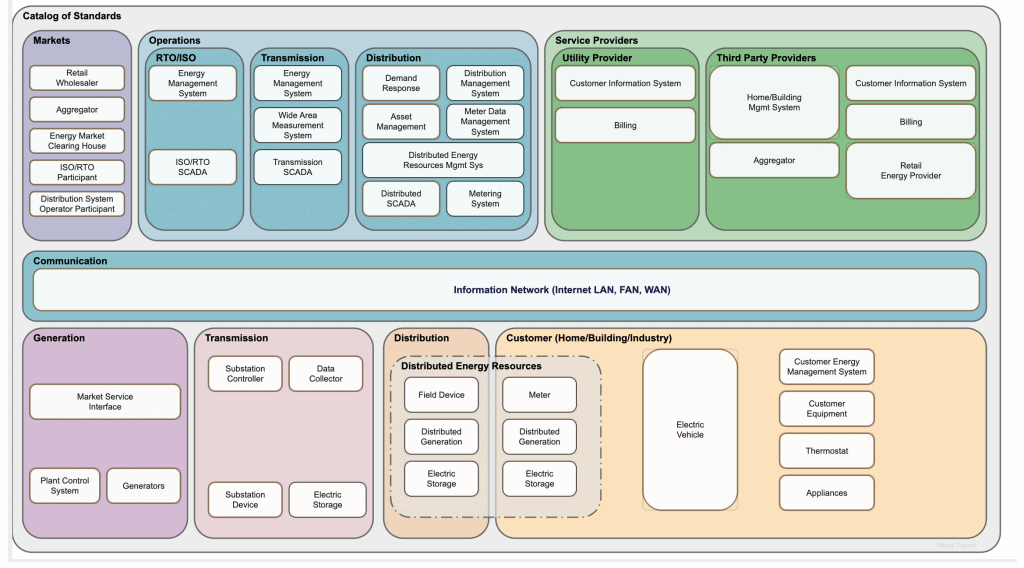

The US Department of Energy’s Office of Electricity explains that the current electricity grid was conceived over a century ago. Back then, the needs of electricity consumers were very different. In the early days, electricity supply to the consumer worked one way. The modern grid is a two-way medium, with end customers becoming the same supply nodes as conventional power generating stations.

Besides household renewable energy power stations, there are also ISO 15118 and Vehicle-to-Grid supply models, which turn the idea of electric energy time-shifting and arbitrage using EV batteries into practice. Opinions vary on the economic and environmental feasibility of V2G, given the current state of Li-ion battery technology. Still, experimental data suggests we will soon see battery improvements that will make V2G feasible (and economically rational).

Energy MVNOs?

Unlike telcos, which by now are mostly privately owned (or privately owned with state interest, the government being “equal among equals” in this case), energy infrastructure and energy supply companies are either still state-owned or privately owned but heavily regulated. (The government being “you do what I say or else” in this case.)

We are going to see energy MVNOs and MVNEs within the coming decades. That’s just the next logical step for utilities and e-mobility, which telecom has used for 20 years. That telecom expertise, along with entrepreneurs who are capable of “translating” that expertise from one industry into another, will be priceless.

Peer-to-Peer Billing?

Nevertheless, it makes little sense for a single company (even less so an individual) to launch a telco when telecom is not how the company makes a profit. In the energy market, the physical nature of the electricity grid requires an energy producer (even if it’s a tiny household solar power station) to sell the energy to the grid or to store it in battery cells. The latter is costly (as we explained above), and you would still have to sell to the grid after your batteries were charged to full capacity.

Becoming a state-licensed energy provider is complicated (at least in developing markets like Ukraine) and not feasible for a single household. However, by now, the diligent reader should have guessed the direction of our thinking. The peer-to-peer concept has already shined in file sharing (sorry, the music industry), secure communication (hello, Signal, and Threema), and elsewhere. Why not use it for the energy business? We will do our research, try a few pilots, and (hopefully) return to you with a new story someday.

TRADACOMS, OSGP, IEEE, and NIST

The idea of using Electronic Data Interchange (EDI) in billing energy and utilities has existed since the 1970s. In 1982, the United Nations introduced the TRADACOMS standard. However, by 1995 it became obsolete and was replaced by the UN in favor of modernized GS1 EDI. Still, TRADACOMS continues to be the de facto standard in the UK, including (surprise!) in billing of utilities.

Compared to EV charging, with its mere five standards, the smart grid has several hundred. The most visible ones are the Open Smart Grid Protocol (OSGP), maintained by OSGP Alliance; and the Framework and Roadmap for Smart Grid Interoperability Standards, maintained by the IEEE’s Smart Grid Technical Activities Committee and the Smart Connected Systems Division of the NIST.

The Great War of the (Scary Acronym) Smart Grid Standards

A clash is bound to happen when you have several hundred standards and a dozen dudes and gals with an ego. OSGP is an industry grassroots standard first envisioned and implemented by Stockholm-based Vattenfall. (Back then, it was Nuon Energy… we like their new logo, though.) IEEE is a standards behemoth now celebrating its 60th year in business. (Or its 139th, if you trace the history to the American Institute of Electrical Engineers.) In 2015, IEEE published research by the Hague-based European Network for Cyber Security titled Structural Weaknesses in the Open Smart Grid Protocol. Begin the fight!

EV Charging Subscription Model: Crossways Between Billing and Consumption Predictions for the Smart Grid

To rephrase a good old classic: All the world’s a subscription, and all the men and women merely paying customers.

The success of billing vendors such as Zuora shows that Apple, Google, Spotify, Netflix, Amazon, and others have done their homework for many customer-facing industries. As we’ve seen in this story, at least two open protocols (OpenADR and OCSP) are currently working with grid predictions that our customers can use in billing software for EV charging.

On the other side of the equation are the customer payment predictions, a viable use case of AI/ML in billing systems. “PortaOne already ventured into predictive billing with PortaBI in 2018. Unfortunately, we had to freeze the project because it was quite ahead of its time, and we needed to focus on revenue to be prepared for the coming crisis,” regrets Andriy Zhylenko. However, what a layperson might regard as a failure, a true entrepreneur regards as simply the first iteration.

If you are a charge point operator or an e-mobility service provider needing billing software for EV charging, please contact sales@portaone.com to learn more about the opportunities PortaBilling might offer your business. Let’s dream, experiment, implement, deploy, and earn together.